What is PAN Card?

What is pan number? what is a pan card?Permanent Account Number (PAN) is a unique ten-digit alphanumeric number allotted by the Income Tax Department. Permanent Account Number (PAN) does not change during life time of the PAN holder even if there is any change in address or there is any change in the Assessing Officer etc…Permanent Account Number is allotted in the form of a laminated card. Know Your Pan. Permanent Account Number (PAN Card) is a ten digit alphanumeric number Card, issued by Income Tax Department in the form of a plastic laminated card. A typical PAN number is AFRPP1595D. |

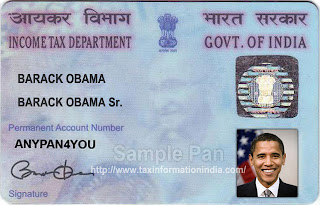

| Sample Permanent Account Number PAN Card |

How to find an IT PAN Service Center or UTI Pan Card Application Center?

Location of IT PAN Service Centers and UTI Pan Card Application Center in any city may be obtained from this website linkWhere can I get PAN Application form?

Click here to download Form 49AWhat services are provided by these IT PAN Service Centers?

IT PAN Service Centers will supply new PAN application forms (Form 49A), assist the application in filling up the form, collect filled form and issue acknowledgement slip. After obtaining PAN from the Income Tax Department, UTITSL will print the PAN card and deliver it to the applicant.How to apply for a PAN? Can an application for PAN be made a plain paper?

PAN application should be made only on Form 49A. PAN application can be made only on new Form 49A A PAN application (Form 49A) can be downloaded from the link and printed by local printers or photocopied (on A4 size 70 GSM paper) or obtained from any other source. The form is also available at IT PAN Service centers and PAN Facilitation centersWhat if I submit incomplete Form 49A?

PAN application should be made only on Form 49A. IT PAN Application Centers will assist applicants to correctly fill up Form 49A, but shall not receive any incomplete and deficient PAN application.Can a person obtain or use more than one PAN?

No, obtaining or possessing more than one PAN is against the law.Will the existing PAN cards issued by the Department remain valid?

All PAN allotted and PAN card issued by the Department will remain valid. All persons who have been allotted a PAN need not apply again. If you have lost your PAN card you can apply for reissue through PAN Application Center and you can check your PAN number hereWhere to apply for PAN?

In order to improve PAN related services the Income Tax department has authorized UTI Investor Services Ltd (UTIISL) to set up and manage IT PAN Service Centers in all cities or towns where there is an Income Tax office and National Securities Depository Limited (NSDL) to dispense PAN services from TIN Facilitation Centers. For convenience of PAN applicants in big cities UTIISL has set up more than one IT PAN Service Center and likewise there are more than one TIN Facilitation Centers.How to apply for a PAN? What form is required to apply for a PAN? Can an application for PAN be made on plain paper?

PAN application should be made only on Form 49A. A PAN application (Form 49A) can be downloaded from the link and printed by local printers or photocopied (on A4 size 70 GSM paper) or obtained from any other source. The form is also available at IT PAN Service centers and TIN Facilitation centersI have applied for PAN but have not received any communication from the Income Tax Department?

In case you applied prior to notification of new form 49A on 29.5.2003 but have not received the PAN, you will have to apply afresh CSF at any IT PAN Service Center.How will my PAN card be delivered to me? Know About PAN

UTITSL will ensure delivery of your PAN card by mail at the address indicated by you in form 49A.Permanent Account Number (PAN)

Who can get Permanent Account Number?

Basically, anybody who applies for PAN can get it. Legally the following persons should have a Permanent Account Number- An Income Tax assessee, or

- Any person carrying on business or profession whose total sales or turnover or gross receipts from business or profession exceeds Rs.5 lakhs, or

- A trust.

Why do you need Permanent Account Number?

Permanent Account Number is required mainly for the following purposes:- For payment of your Income Tax

- To file Income Tax Returns or tax filing

- To avoid TDS (Tax Deducted at Source ) at higher rates

- For transactions like the following:

- sale or purchase of immoveable property valued at Rs 5 Lakhs or more,

- sale or purchase of a motor vehicle or vehicle other than a two wheeler,

- payments to hotels and restaurants of an amount exceeding Rs.25,000 at any one time,

- cash payments to travel agents for travelling abroad of a payment exceeding Rs.25,00 at any one time,

- purchase of RBI bonds for an amount of Rs.50, 000 or more.

- Transaction in securities or shares exceeding Rs.50, 000

- For opening new bank accounts.

- For opening a time deposit or a fixed deposit exceeding Rs.50, 000 with a banking company.

- For applying for the allotment of a telephone connection including a cellular connection.

- Purchase of bullion or jewelry for a value exceeding Rs.5 lakhs.

How can I get pan card?

Where to apply for pan card?

Income Tax Department has authorized UTIISL ( UTI Infrastructure

Technology and Services Ltd) and NSDL (National Securities Depository

Limited) to set up and manage Permanent Account Number (PAN) service

centres . The applicant needs to submit the respective application forms

in these centres or they can even apply online through their websites (www.utiitsl.com) or (www.tin-nsdl.com)Three types of Permanent Account Number (PAN) application forms are:- Form 49A – Application form to be submitted by individuals who are Indian citizens, Indian companies, entities incorporated in India and unincorporated entities formed in India for obtaining a new PAN card.

- Form 49AA – Application form to be submitted by individuals who are not the citizens of India, entities incorporated outside India and unincorporated entities formed outside India.

- Request for NEW PAN card or changes in the PAN data form – This application form can be used by anyone (individual, company or any other entity) to change the data in the PAN database like address, father’s name, date of birth or incorporation etc.. OR to obtain a new PAN card in case the old PAN card is lost.

Fees for applying pan card

With effect from April 1 2012, fees for PAN application has changed to Rs.96. For NRI and for PAN to be dispatched outside India, the fee is Rs. 962.What are the documents required for applying pan card?

- Affix one recent colour photograph (Stamp size: 3.5 cms x 2.5 cms) on the relevant form.

- Any one document listed in Rule 114 needs to be submitted as proof of ‘identity’ and ‘address’.(See details below)

- Mention the designation and code of the concerned Assessing officer of Income Tax Department. You can get the list of AO codes for PAN from this link (https://www.tin-nsdl.com/pan/pan-aocode.php)

Documents acceptable as proof of identity and address as per Rule 114 of Income Tax Rules, 1962 Proof of Identity

(Copy of any one of the following)- School Leaving Certificate

- Matriculation Certificate

- Degree of recognized educational institution

- Credit card statement

- Bank account statement/Bank pass book

- Depository account statement

- Water bill

- Voters ID card

- Passport

- Ration card

- Property Tax Assessment order

- Driving License.

- Certificate of identity signed by Member of Parliament or Member of Legislative Assembly or Municipal councillor or Gazetted officer in the prescribed format. The prescribed format is available here. ( https://tin.tin.nsdl.com/pan/GazetteCertificate.pdf )

Proof of Address (Copy of)

- Electricity Bill

- Telephone Bill

- Employer Certificate

- Depository Account Statement

- Bank Account Statement or Bank Pass Book

- Credit Card Statement

- Rent Receipt.

- Ration Card

- Property Tax Assessment Order

- Passport

- Voter ID Card

- Driving License

- Certificate of address signed by Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officer in the prescribed format. The prescribed format is available here. (https://tin.tin.nsdl.com/pan/GazetteCertificate.pdf)

After applying for the PAN card

You will receive a unique 15 digit acknowledgement number which will help you in tracking the application and know the status. It takes about 15 days to get a PAN allotted if you have submitted the form at uti or nsdl. But if you have applied it online, you will get the PAN within 5 days. If there is undue delay in getting the Permanent Account Number or PAN card, contact the Aaykar Sampark Kendra (0124-2438000 or 95124-2438000 from NCR) or send an email to pan@incometaxindia.gov.in. And if you have the PAN but not the PAN card, you can apply for a duplicate PAN cardAfter receiving

- Ensure that all the information is printed properly on the PAN card.

- Do remember to mention your Permanent Account Number on all communication with Income Tax Department.

- It is illegal to obtain two PANs. If you have more than one Permanent Account Number inform the concerned Assessing Officer as soon as possible.

What does each digit in PAN stand for?

Permanent Account Number is a ten-digit alphanumeric number.A typical PAN is ABCPK1234L.

First three characters “ABC” are alphabetic series running from AAA to ZZZ.

Fourth character “P” represents the status of the PAN holder. “P” stands for Individual, “F” stands for Firm, “C” stands for Company, “H” stands for “HUF”, “A” stands for AOP, “T” stands for Trust etc…

Fifth character “K” represents the first character of the PAN holder’s last name or surname.

Next four characters “1234” are sequential number running from 0001 to 9999.

Last character “L” is an alphabetic check digit.

Always Remember

- A person can have only one Permanent Account Number during his lifetime. You do not need to apply for a new PAN when you move from one city to another.

- Father’s name is compulsory for female applicants; including married/divorced/widow applicants.

When to apply for a new PAN?

- Partition of a bigger HUF (Hindu Undivided Family) into one or more new (HUFs).

- Change in constitution of a firm which results in the change of partners.

- Splitting up or demerger of an existing company into two or more companies.

Events to be reported to the Assessing Officer

- Death of a PAN Holder

- Discontinuation of a business

- Dissolution of a firm

- Partition of HUF (Hindu Undivided Family)

- Liquidation or winding up of a company.

- Merger, Amalgamation etc… of companies

PAN Contact Info: Whom can I contact for inquiries regarding PAN applications? Know About Your PAN:

Regarding PAN applications, Mention your coupon number or acknowledgement number in all communicationsRegarding all PAN Grievances

http://incometax.sparshindia.com/pan/pan.asp

Useful Links

http://www.incometaxindia.gov.in/

http://www.utiitsl.com/

https://www.tin-nsdl.com/

All such inquiries related to PAN should be addressed to:

For NSDL

The Vice PresidentIT PAN Processing Centre,

UTI Technology Services Ltd

Plot No. 3, Sector - 11

CBD_ Belapur, NAVI Mumbai-400 614

e-mail.- utitsl.gsd@utitsl.co.in

Tel No. 022-67931300, Fax No. 022-67931099

For UTIISL

The Vice PresidentIT PAN Processing Centre

UTI Investor Services Ltd

Plot No. 3 Sector - 11

CBD_ Belapur

Navi Mumbai-400 614

e-mail.- utiisl-gsd@mail.utiisl.co.in

Tel No. 022-27561690

Fax No. 022-27561706

What is PAN Card? and All Frequently Asked Questions about PAN Card, PAN Card Enquiry Duplicate PAN Card Application Know PAN Card PAN NSDL Income Tax India PAN Card Details PAN Number PAN No

No comments:

Post a Comment